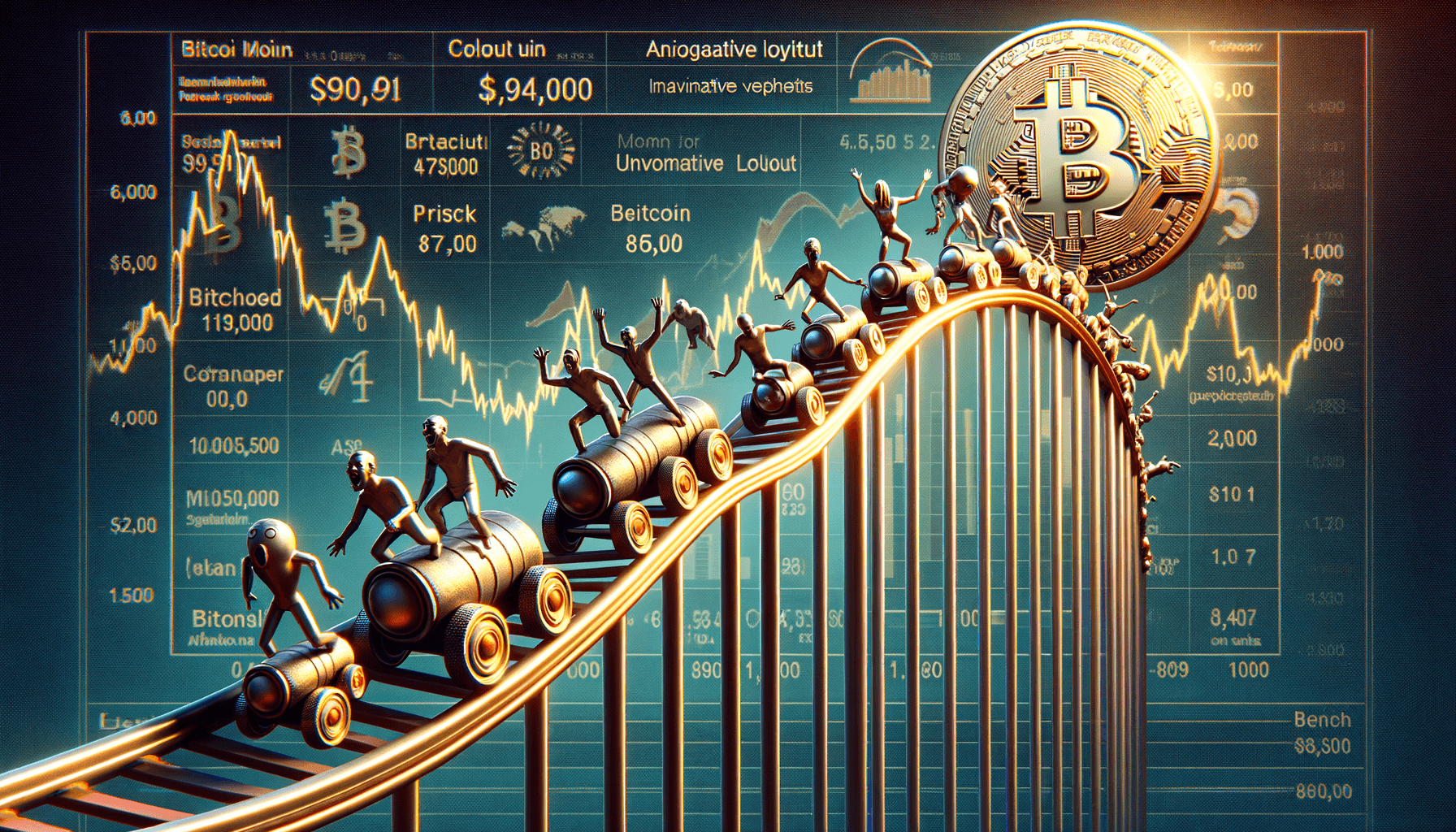

Bitcoin Surges to $90K, Drops to $85K in 4 Hours

Bitcoin surged to $90,000 before dropping to $85,000 in just 4 hours on December 17, 2025.

On December 17, 2025, Bitcoin experienced a rapid price movement, surging above $90,000 before plummeting to $85,000 within a span of just four hours. This volatile swing highlights the ongoing unpredictability in the cryptocurrency market.

Price Action Details

At the time of writing, Bitcoin's price stands at $85,500, marking a 24-hour decline of 4.5%, a 7-day decrease of 2.1%, and a 30-day increase of 12.3%. Key support levels are currently at $84,000 and $82,000, with resistance at $88,000 and $90,000. Today's trading volume reached $56 billion, which is 15% higher than the average daily volume of the past month. The market cap of Bitcoin now stands at $1.63 trillion, reflecting a slight decrease from its peak during the surge.

Driving Factors

The sudden spike in Bitcoin's price was triggered by a combination of factors, including a significant purchase by the institutional investor Grayscale Investments amounting to $500 million in BTC. On-chain data from CoinGecko shows a 20% increase in large transactions over $100,000 in the past 24 hours, suggesting increased whale activity. Additionally, news of a potential approval of a Bitcoin ETF by the SEC, as reported by The Block, may have fueled the initial surge before profit-taking led to the rapid decline.

Broader Market Context

Compared to other major cryptocurrencies, Ethereum saw a more modest 1% drop to $3,200 over the same period. The DeFi sector experienced a total value locked (TVL) decrease of 3%, now standing at $120 billion as per DefiLlama. The NFT market volume dropped by 5% to $250 million, according to OpenSea. The Fear & Greed Index currently sits at 65, indicating a market in a state of greed, which may contribute to the volatile swings. Analyst Tom Lee from Fundstrat Global Advisors predicts that Bitcoin could reach $100,000 by the end of Q1 2026, citing increasing institutional adoption and macroeconomic factors.

Why This Matters

The rapid price movement of Bitcoin underscores the market's sensitivity to news and institutional actions. Such volatility can impact investor sentiment and trading strategies, particularly in the lead-up to potential regulatory changes like the SEC's decision on Bitcoin ETFs. Understanding these dynamics is crucial for market participants looking to navigate the crypto landscape effectively. The interplay between on-chain metrics and external news highlights the multifaceted nature of cryptocurrency markets, emphasizing the need for continuous monitoring and analysis.

Sarah covers decentralized finance with a focus on protocol economics and tokenomics. With a background in quantitative finance and 5 years in crypto research, she has contributed research to OpenZeppelin documentation and breaks down complex DeFi mechanisms into actionable insights for developers and investors.