Brazil's Top Bank Urges 3% Bitcoin Allocation by 2026

Brazil's largest private bank advises a 3% Bitcoin allocation by 2026, sparking a strategic shift in investment.

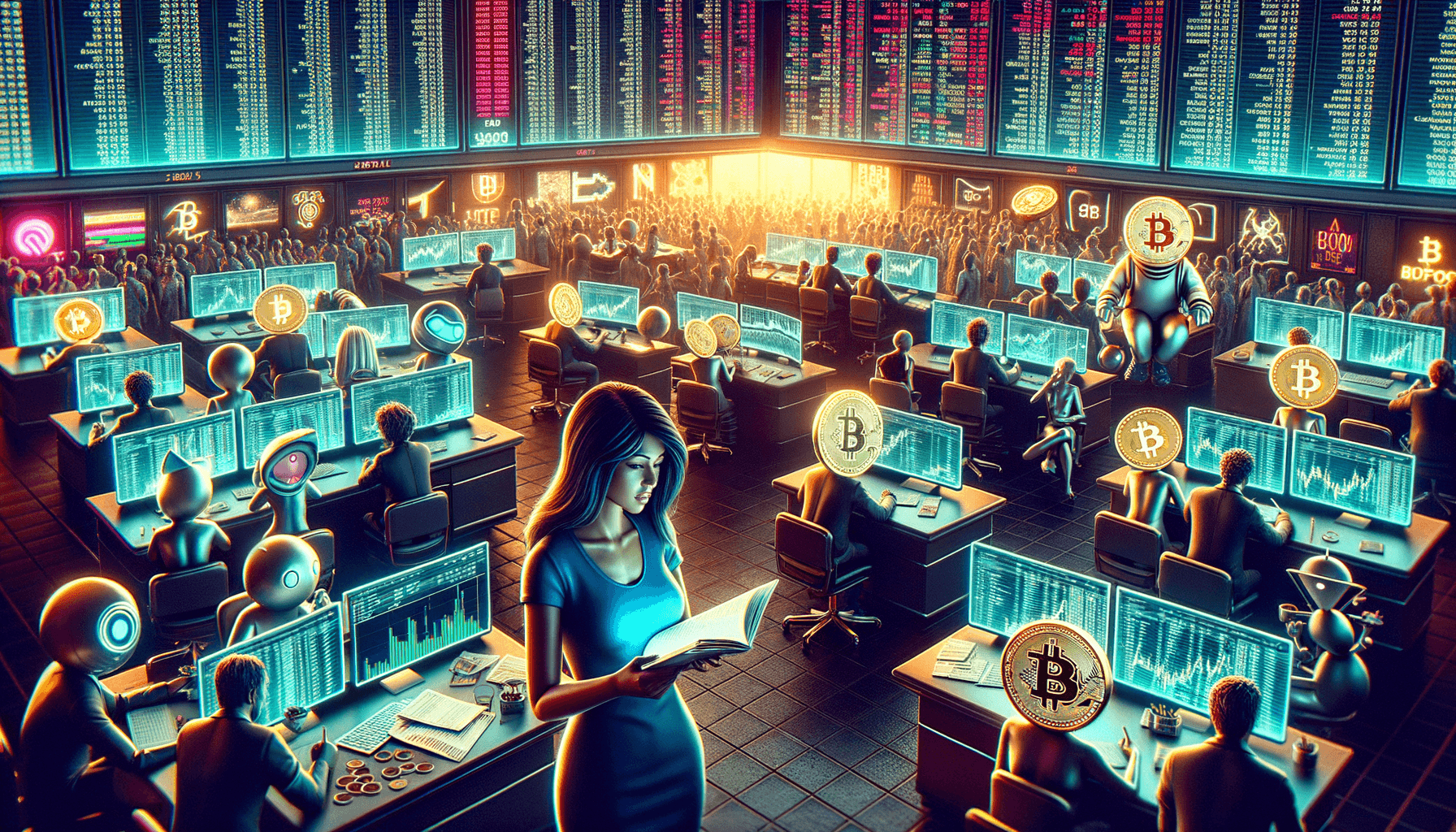

The trading floor buzzes with anticipation. It's Tuesday, December 13, 2025, and the air is thick with the scent of coffee and ambition. On the screens, Bitcoin's price flickers, but the real story today isn't the volatility; it's the strategic shift from Brazil's largest private bank. They've just released a report, and it's causing ripples through the room.

In the center of it all, Maria Silva, a senior portfolio manager, scans the document with a mix of excitement and skepticism. She knows the stakes. Brazil's economy has been turbulent, and the bank's advice to allocate 3% of portfolios to Bitcoin by 2026 could be a game-changer for her clients.

The report argues that Bitcoin can enhance portfolio diversification and hedge against currency risk. But it's not just about the numbers. It's about a shift in perspective, a bold move in a volatile market.

As Maria reads, she recalls a conversation with a colleague who'd been skeptical of crypto: 'It's not just a speculative asset anymore,' he'd said. 'It's a tool for stability in our unpredictable financial landscape.'

The tension builds as Maria weighs the decision. The bank's recommendation isn't just a suggestion; it's a signal. A signal that the future of investment might be more digital than ever before. She feels the weight of responsibility, knowing that her next moves could shape the financial future of her clients.

Finally, the resolution comes. Maria decides to take the plunge. She'll recommend the 3% allocation, trusting in the bank's analysis and her own belief in the potential of Bitcoin. It's a risky move, but one she feels is necessary in these times.

As she walks away from her desk, the trading floor continues its relentless pace, but Maria feels a sense of calm. She's made her decision, and now, it's up to the market to decide if it was the right one.

Marcus is a smart contract security auditor who has reviewed over 200 protocols. He has contributed to Slither and other open-source security tools, and now focuses on educating developers about common vulnerabilities and secure coding practices. His security alerts have helped prevent millions in potential exploits.